Pet Health Insurance

Give your entire family the protection they deserve.

Pet Insurance reimburses you for your dog or cat’s unexpected medical bills.

How it works

Your pet is treated at any veterinarian for sickness or injury. You submit the bill to Figo for reimbursement by simply snapping a photo of your vet bill. Then, you upload the photo via Figo’s Pet cloud mobile app to be reimbursed for the costs in an average of 7 days. It’s that easy!

Why you need Pet Insurance

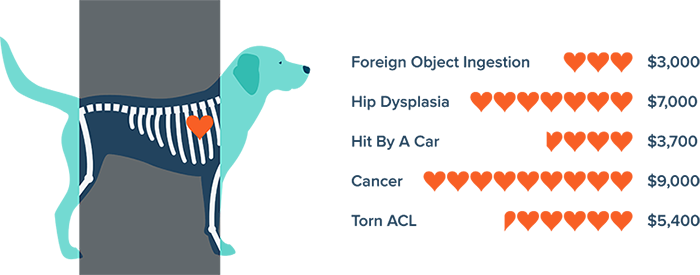

Advancement in veterinary medicine save more pets than ever, and those treatments can be really expensive. See average costs for dog health emergencies below:

Why choose the Figo program

For an average cost of $1.25 per day, Figo lets you fast any licensed veterinarian, specialist, and ER in the US, Canada or Puerto Rico. Enrollment is easy and Figo’s customer care team is accessible by phone, email, text, chat and Twitter.

More than Pet Insurance

With your Figo policy, you also receive the first-ever Pet Cloud with a mobile app to manage your pet’s life. Some features of the Pet Cloud include:

- Access to your pet’s records for travel and emergency

- Text and email reminders for pet health appointments

- Lost pet technology using GPA and family text alerts

- Pet-friendly business locator

By purchasing your policy through American Heritage, you will receive an addition 5% on your policy premium.

Shop with us

American Heritage Insurance Group is the premiere Pet Insurance Agency for the Cincinnati and Dayton Region. We offer you over 50+ combined years of insurance expertise and have a dedicated agent specifically for Pet Insurance.

American Heritage has three office locations in Ohio, making it easy and convenient for you to meet with an agent. From our dedicated experience to carrier partnerships, American Heritage will be an asset to your Pet Insurance needs.

Frequently asked questions

Is a veterinary exam required to enroll in Figo Pet Insurance?

This is not a requirement for a veterinary exam to enroll. If you cannot provide medical records showing your pet’s annual health exam by a licensed veterinarian occurring within the 12 months prior to the effective date of your Figo policy, the first documented veterinary examination after the effective date of the policy will be used as the basis for determining any pre-existing conditions. It is recommended that you get this done as soon as possible.

What is the annual deductible?

The good news is that Figo has an “annual deductible” policy. This means that you can submit any size claim at any time during the policy year. So, once you have met your chosen annual deductible (applied to your veterinary bill for any covered loss, after your copay), then you no longer have to pay a deductible for the remainder of your annual policy period! At this point, all you would be responsible for is your selected copay of any covered treatment. In other words, Figo will reimburse you the rest!

With our different deductible options, you can tailor your policy to fit your needs. Choose from: $50, $100, $200 and $500.

How do you determine a pre-existing condition?

We will evaluate your pet’s medical history during the claim process to determine if the condition existed prior to your enrollment and the subsequent waiting period (14 days for illness and 5 days for accident/injury).

In general, a pre-existing condition is a medical condition (signs or symptoms) which first occurred before the effective date of your Figo policy or which occurred during the policy waiting period.

If your pet has not been examined by a licensed vet in the 12 months prior to the beginning of your policy, then your pet’s pre-existing conditions will be determined at their next visit to the veterinarian’s office.

What's covered under the Figo Pet Insurance plan?

Veterinary Exam Fee – We cover the veterinary exam fee for covered treatments. Please be aware that some other pet insurance companies will not reimburse you the veterinary exam fee even if associated with an illness or injury. Keep in mind, routine exams are not covered under your Figo policy, as they are considered preventative or maintenance exams.

Emergency and Hospitalization – We cover all emergency and hospital care.

Surgery – We cover all forms of surgery needed to treat your pet as long as it is relating to a covered injury or illness.

Hereditary and Congenital Conditions – We cover hereditary or congenital conditions (some companies don’t), as long as they are not considered to be a pre-existing condition.

What is a hereditary condition? A hereditary condition is passed down from a pet’s parents. Pure breeds, especially dogs, are particularly susceptible.

What is a congenital condition? A pet can develop a congenital condition in utero, before the pet is born. These conditions can often lead to other complications and diseases.

Hereditary and congenital conditions in dogs and cats can cause pretty serious problems later in life. These problems can be very expensive to treat. Figo has decided to cover them to make sure you and your pet are protected when you need it most.

Prescription Medications – We cover prescriptions prescribed by licensed veterinarian that relate to the treatment of a covered illness or injury.

Cancer Treatments – Cancer places fear into all of our hearts. Luckily, advancements are being made in animal medicine that are saving and extending the quality of life for both dogs and cats. We are proud to cover the most advanced, cutting edge treatments for cancer, such as CyberKnife™ Radiosurgery. We know that your pet is irreplaceable which is why we will fight alongside you to keep them healthy and happy by covering the treatment that is best for their recovery.

Specialty Care – Specialty clinics and hospitals are required for advanced surgeries or treatment that your primary veterinarian is unable to perform. No referrals are required and we do not limit coverage for the specialists (Caution: some pet insurance companies do). Some examples of Specialty Care include: Oncologists for cancer treatments, Cardiology, Neurology, Internal Medicine Experts, Radiology, Surgery, Advance Imaging, Orthopedics and Critical Emergency Care.

Chronic Conditions – Any chronic condition that first shows signs after your policy waiting period, is covered for the life of your pet as long as they maintain continuous coverage with Figo. Some common chronic conditions include: allergies, diabetes, obesity, cancer, dry eyes and asthma.

X-Rays, MRIs, Cat Scans, Ultrasounds & Blood Work – Diagnostic testing considered medically necessary by a licensed veterinarian to help diagnose or treat your pet for an illness or injury is covered under our policy.

Ligament and Knee Conditions Such as Anterior Cruciate Ligament (ACL) Conditions – While our policy has a 6 month waiting period on this coverage, that waiting period will be waived if your veterinarian certifies your pet’s knees are healthy. Please see “the other knee if my pet has cruciate treatment history” in the Policy Exclusions section.

Hip Dysplasia – While some companies exclude hip dysplasia, Figo fully covers it as long as it is not deemed pre-existing.

Rehabilitation – We cover rehabilitation treatments as long as they are performed by a licensed veterinarian and for the treatment of a covered illness or injury.

Prosthetic and Orthotic Devices – Figo provides coverage for orthotics, prosthetics, and carts, under all plans, as part of a treatment plan for a covered illness or injury. We are proud provide a benefit that helps disabled pets live happy, normal lives.

Physical Therapy – We cover physical therapy when it is related to a covered illness or injury and administered by a licensed veterinarian.

Holistic and Alternative Therapies (Including Homeopathic, Acupuncture, Chiropractic) – We cover holistic and alternative therapies when they are related to a covered illness or injury and administered by a licensed veterinarian.

Stem Cell Therapy – Our policy covers stem cell therapy if it is provided by a licensed veterinarian who deems it necessary for the treatment of your pet’s covered illness or injury.

Non-Routine Dental Treatments – Figo covers dental treatment if it is part of a treatment plan for a covered accident or illness. We do not cover routine, preventative dental.

Costs of Euthanasia – We will cover the cost of euthanasia as long as it is deemed medically necessary by your veterinarian and it is the result of a covered accident or illness.

Behavioral Therapy – Figo covers behavioral therapy. The maximum benefit that we will pay for consultations by a veterinarian to diagnose and treat behavioral problems is subject to the policy plan chosen:

Essential = $250 annually Preferred = $500 annually Ultimate = $1000 annually

Boarding Kennel & Cattery Fees – If your pet is insured under either the Preferred or Ultimate plan, Boarding Kennel & Cattery Fees coverage is included in their policy. Boarding Kennel & Cattery Fees coverage means that we will pay up to $250 in the Preferred Plan (up to $500 in the Ultimate package), for the boarding your pet at a licensed kennel or cattery if you are hospitalized for 96 hours or more due to sickness, disease or bodily injury.

Advertising & Reward – As an added benefit of our Preferred and Ultimate plans, we include coverage for Advertising & Reward. Advertising & Reward coverage protects you if your pet is stolen or strays during the policy period. We will pay for the cost of advertising or offering a reward, up to $250 in the Preferred plan and up to $500 in the Ultimate plan. No co-pay or deductible would apply to this coverage.

As soon as you find your pet is missing, in order for coverage to apply, please make sure to do the following steps:

1. Notify the police that your pet is missing and be sure to ask for a reference number and written confirmation of your report.

2. Notify the five closest veterinary clinics or animal shelters to the area where your pet was last seen.

3. Save any receipts for advertising and reward.

Loss Due To Theft or Straying – If you are in our Preferred or Ultimate plans and your pet is stolen or goes missing during your policy period and is not found within 30 days, we will pay up to $250 for price you paid for your pet if you are in the Preferred plan (up to $500 in the Ultimate plan).

If you did not pay for your pet or are unable to locate the original paid receipt, we will still provide coverage. In this scenario, we will pay the lesser of the current local humane society adoption fee for the species of your pet or $150. There is no co-pay or deductible applied to this coverage.

As soon as you find your pet is missing, in order for coverage to apply, please make sure to do the following steps:

1. Notify the police that your pet is missing and be sure to ask for a reference number and written confirmation of your report.

2. Notify the five closest veterinary clinics or animal shelters to the area where your pet was last seen.

Vacation Cancellation – We offer Vacation Cancellation coverage as a benefit in our Ultimate plan. This means, if you plan your dream vacation and your pet suddenly needs immediate life-saving treatment, you are not left high and dry.

If you are in the Ultimate plan, we will pay up to $1,000 for any travel and accommodation costs that you are unable to recover as a result of having to delay, cancel or interrupt your vacation because your pet requires immediate life-saving treatment. This means either while you are away or up to 7 days before you leave. There is no co-pay or deductible applied to this coverage. There are some exceptions to this coverage so please see Vacation Cancellation Exclusions in the FAQ’s.

Mortality Benefit – If you are in the Ultimate plan, we will pay up to $1,000 if your pet dies or has to be euthanized by a vet during your policy period as a result of a covered illness or injury. The coverage includes up to $250 for cremation and burial expenses. It also provides reimbursement for the price you paid for your pet. If you did not pay for your pet or are unable to find the original receipt showing how much you paid, we will pay you the lesser of the current local humane society adoption fee for the species of your pet or $150. There is no co-pay or deductible applied to this coverage. There are a few reasons why your Mortality Benefit claim may not be covered. See the Mortality Benefit Exclusions description in this FAQ.

Working Dogs – Figo does insure Working Dogs. Due to the higher risk of injury there is a 10% increase in premium. Please call us at (844) 738-3446 if you have a working dog and are interested in purchasing a policy.

What is not covered by the Figo Pet Insurance program?

Pre-existing Conditions – Any condition that shows clinical signs prior to the start of your policy period (and relevant waiting periods), will not be covered. A quick analogy to put this in perspective: you wouldn’t buy an insurance policy on a broken down automobile and expect them to pay to fix it the next day, would you? That insurance company wouldn’t be in business very long.

Routine or Preventative Care – While routine wellness or preventative care is critical to your pet’s future health and happiness, it is not something covered on our policy.

Spaying or Neutering – Sorry, we do not cover this procedure but unless you have plans for your pet to breed, we highly recommend getting it done to avoid future health problems.

Pets less than 6 weeks old – They are oh so cute, but not yet mature enough for our policy.

Cosmetic Surgery – Your pet is beautiful just as they are. No need to try and improve!

Elective Surgeries – We provide coverage for the surgeries that your veterinarian recommends for treatment of accidents and injuries. Elective surgeries are not covered.

Supplements – Coverage for supplements is not included in our policy. If you are unsure if your pet’s medications are supplements or prescription medication, please ask your veterinarian.

Obedience or Training Classes and Devices – If your pet can sit, shake and roll over, congratulations, that is quite a feat! It’s really something to be proud of; something that you and your pet accomplished together.

Unfortunately, obedience or training classes and devices are not something that this accident and illness policy covers.

Grooming – The up-keep of your pet’s exterior is important to their quality of life and their self-confidence – keep them selfie-ready!

Failure to Adhere to Veterinarian’s Preventative & Treatment Advice – It’s important to listen to the experts- especially in the care and keeping of your pet.

Anything not administered by a Veterinarian – You wouldn’t want someone other than a licensed professional to take care of you – same goes for your pet!

Breeding, Pregnancy, or Giving Birth – Our policy does not provide coverage for maternity, breeding, pregnancy, whelping or nursing; however, we may provide coverage due to complications that arise after the waiting period.

Eating Poop or Other Eating Disorders – These pets will eat it all; however, the ingestion of poop is not something that is covered on our policy. And it is certainly not recommended. Other than being gross, it can cause severe health problems for your pet.

Inhumane Treatments – We know you would never do this, so it isn’t even worth discussing.

Neglect or Abuse – We know you would never do this, so it isn’t even worth discussing.

Racing, Coursing or Organized Fighting – It would be great if racing, coursing or organized fighting never happen – those poor pets! However it does, and it is something that is strictly excluded from our policies. If you are using your pet for these activities, we are not the company for you.

Experimental Procedures – Taking risks on your pet’s health is not something that we recommend. Our policy does not cover the risk of experimental procedures.

Cloned Pets or Cloning Procedures – Sorry, we don’t cover your quest to duplicate your beloved pet. Create your pet’s “mini-me” at your own risk. Just remember that each pet has a unique soul, so duplicating the exterior does not duplicate what makes your pet so wonderfully unique on the inside.

Chemical, Biological or Nuclear…bad events – Let’s hope that none of these this happens… but if they really were to occur, we have bigger problems. It is standard insurance practice not to cover these events.

War, Invasion, Revolt or Quarantine – Let’s hope that none of these this happens… but if they really were to occur, we have bigger problems. It is standard insurance practice not to cover these events.

What exclusions are there to the Figo Pet Insurance program?

Boarding Kennel & Cattery Fees Exclusions – Our policy does include some exclusions to the Boarding Kennel & Cattery Fee’s coverage and we want to make sure that they are easy to understand and clearly stated. In order for this coverage to apply, the pet owner must be admitted to the hospital for a minimum of 96 hours.

If your injury or illness first revealed itself before your pet was covered under this policy or if you are hospitalized for treatment of alcohol abuse, drug abuse, suicide attempt or self-inflicted injuries, this coverage will not apply.

If you are hospitalized due to receiving any treatment that is not related to sickness, injury, disease or due to giving birth, which did not result from a medical emergency, this coverage will not apply.

If you are treated in a care setting other than a hospital, this coverage will not apply.

Advertising & Reward Exclusions – Coverage under Advertising & Reward will not be applied if you are unable to submit a signed receipt detailing the full name and address of the person who found your pet or if the reward was paid to any person living with you, related to you, employed by you or a person who is well-known to you or your pet.

There will be no benefits paid out under this coverage if the disappearance of your pet resulted from your neglect or deliberate concealment.

Loss Due to Theft or Straying Exclusions – We will not pay any benefits if you, or the person looking after your pet, freely parts with your pet even if tricked into doing so.

Vacation Cancellation Exclusions – The Vacation Cancellation coverage will not provide any benefits if the vacation was booked less than 28 days before you were due to leave. Nor will this coverage assist in reimbursing any cost of vacation cancellation insurance.

Mortality Benefit Exclusions – There are a few reasons why your Mortality Benefit claim may not be covered:

1. If your veterinarian is not able to confirm your pet’s death or sign the death claim form.

2. If your dog is 8 years or older and dies as the result of illness or your cat is 10 years or older and dies as the result of illness.

3. If your pet was euthanized at your request and not at the suggestion of the vet, or because of behavior or emotional disorder, including aggression.

Lastly, there would be no benefit to have your pet examined or tested post-mortem.

The “other knee” if my pet has cruciate treatment history – Unfortunately, research shows that once one knee has been injured, it is much more likely that the other will follow in injury as well. If your pet has shown clinical signs of a cruciate or soft tissue injury to one knee prior to the effective date of this policy, or during the first 6 months of the policy (where no certification of knee health has been provided) and appropriate treatment has not been performed, then the other knee is automatically excluded from coverage.

Once the appropriate treatment has been performed, the other knee will be excluded from coverage for a period of 12 months from the date of last treatment to the affected knee. So, if you stay on top of treatment, and the other knee is still healthy and showing no clinical signs of a soft tissue injury, coverage is possible.

This exclusion applies when the first knee started showing signs or symptoms of a condition or injury prior to the start of your policy or during the 6 month knee waiting period.

Therapeutic Pet Food – We will cover the cost or fees for food if it is used to dissolve existing bladder stones and crystals in urine. In this circumstance, we will only pay for the food for up to 6 months of treatment. After this, we may request a urine sample from your pet to determine if continued treatment is necessary.

Other than this situation, we do not cover the costs or fees for food, including food prescribed by your vet, to treat or prevent illness.

Supplements – Coverage for supplements is not included in our policy. If you are unsure if your pet’s medications are supplements or prescription medication, please ask your veterinarian.

Intervertebral Disc Disease – The only exclusions in coverage that apply to Intervertebral Disc Disease are when another disc in the same or neighboring spinal region was previously treated or showing clinical signs prior to the effective date of your policy or during the 14-day waiting period for illnesses. This waiting period begins on the effective date of your policy.

Where can I find out more information about the Figo Pet Insurance Plan?

For more information specifically about your Pet Insurance plan, please call 513.984.5255.

If you have questions in regards to the Figo program, click here for more information.