When shopping for a home, you might find yourself jumping in without a plan to just “look.” That’s great, but you should at least have an idea of the process so you don’t find yourself making a purchase you soon regret. Before buying a home, read our lastest blog!

How do I start the process of buying a home?

To start your home search, begin by establishing your housing needs, budget, finances and obtaining a preapproval. After that, you can create your wish list, but keep in mind that you might not be able to afford everything you desire.

Consider the following questions for your wish list:

- What part of town do you want to live in?

- Are schools a factor?

- Older home or new?

- One story or two? Condo?

- Contemporary or traditional? Something else entirely?

- Fixer-upper or move-in ready?

- Near public transportation or other amenities?

- How many bedrooms? How many bathrooms?

- Yard? Fenced?

Once you’ve established what you need, want and can afford, check out these helpful home buying checklists to keep track of properties you view or are considering:

How much money do I need when buying a home?

How much money do I need when buying a home?

Determining how much money you need when buying a home depends on a lot of factors. Almost anything can impact home cost, but major factors include your location, the square footage of the home, and how updated it is. Based on my personal experience, homes in nice neighborhoods that are outdated will still be high in price, homes in okay neighborhoods that are completely renovated will be high in price, and homes in bad neighborhoods that are updated will seem fair for what you’re receiving. This doesn’t mean you should settle for an outdated home or in a bad neighborhood. Consider looking at homes that are semi-updated in neighborhoods you can afford. By doing this, you can plan for upgrades down the road.

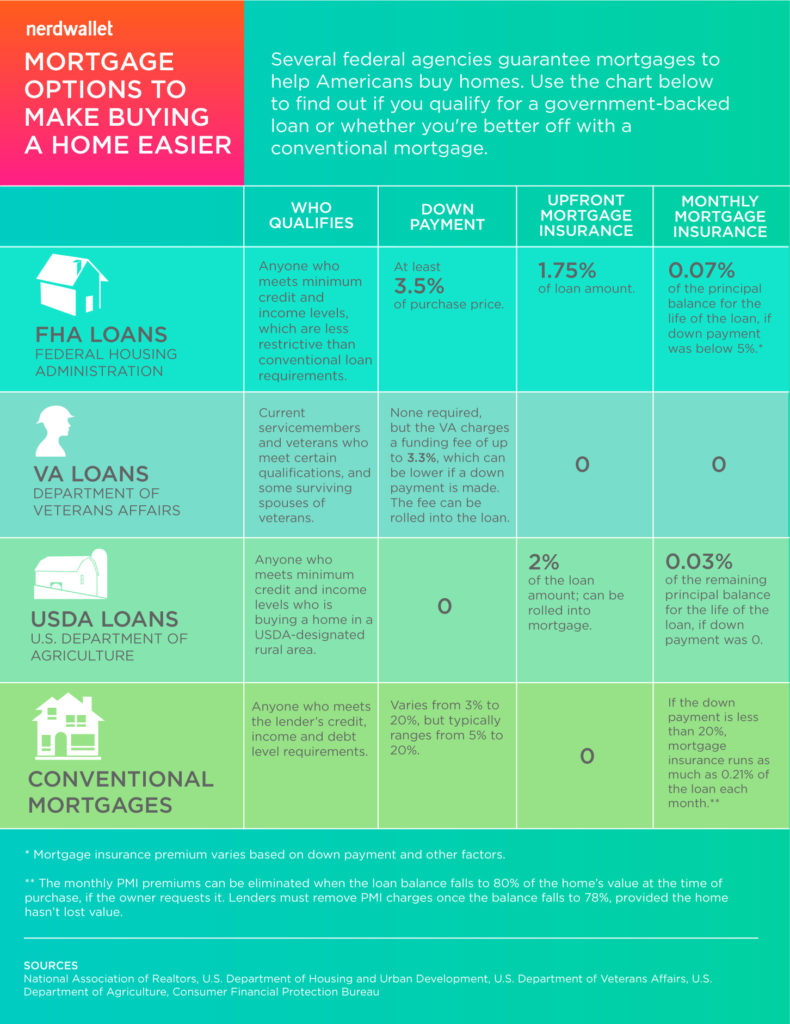

One thing that will help you determine how much money you need is by seeking pre-approval for a home loan. By doing this, you will know your limit and possibly the percentage of down payment you need. Also, by meeting with a real estate agent, they can help you to understand the financials of purchasing a home.

What is the typical timeline for buying a home?

There isn’t a standard timeline when buying a home, but there is a typical guideline so you don’t find yourself rushed into buying a home you don’t truly love. Also, by pre-planning your home purchase, you allow yourself time to check and re-check paperwork, line up inspections and figure out last minute details such as a moving company and how you’re going to furnish the home.

We recommend considering our timeline we’ve created with the help of several sources. It’s included in our free home buying guide which can be downloaded here.

Next steps to take

First, I want to say congrats for starting your home buying journey! It’s an exciting time for you and anyone involved. While stressful, we hope our information will help you successfully find and purchase a home you love. Don’t forget to download our Home Buying Guide for more tips!

Have you purchased a home previously? If so, we want to hear from you! Let us know what tips you have for new home buyers by commenting below.

Sources: Nerdwallet 1, 2, 3, 4, Huffington Post

Leave a Reply

You must be logged in to post a comment.