There is no shortage of reasons your home insurance rates may have gone up, but the likely culprits in 2022 are rising labor and construction costs due to inflation and expensive natural disasters. Around a month before the end of your policy term, your insurance company will send you a notice reminding you that your homeowners […]

How does inflation affect insurance rates?

Like most other goods and services, inflation can also increase the cost of insurance. Insurance and inflation When determining insurance premiums, insurance companies look at a variety of factors including industry trends like number of claims and costs to repair vehicles and homes. If those costs increase, the price of insurance premiums will likely increase […]

Average homeowners insurance cost (updated for 2022 inflation)

The average cost of home insurance is around $158 a month or $1,899 per year in 2022. But how much you pay will vary based on where you live, how old your home is, and other factors. How much is homeowners insurance? The average cost of homeowners insurance in the U.S. is $158 a month or $1,899 per year, […]

Why Home and Auto Insurance Rates Are Rising in 2022

Why home and auto insurance rates are rising in 2022 Thanks to an unusual convergence of market trends, ushered in by the pandemic and other disruptive events, you may see a bigger change to the cost of your home and auto insurance than usual when it comes time to renew your policies this year. Insurance […]

6 Tips to Help Deter a Break-In

Every 13 seconds, a burglary occurs somewhere in the U.S., adding up to approximately 2.5 million burglaries each year, according to Alarms.org. Two-thirds of those crimes are home break-ins, and if it were not for home security systems, that figure could be significantly higher – a study from UNC Charlotte found that 83% of convicted […]

What to Know About Insuring a Historic Home

Whether your historic home is new to you or has been in the family for generations, an essential element of taking care of the property is adequate insurance. “Insuring a historic home can be very different from insuring a newer home,” said Dawn Meadows, an insurance adviser with Clarke & Sampson in Alexandria, Va. “The […]

Alpaca Stampede, Spoiled Wedding Cake, Teacher Defamation – What’s the Insurance Link?

Picture this: Your next-door neighbor Gary runs an alpaca farm. Most of the time, the alpacas are happy springing along, munching on grass, and looking cute. But one one occasion, a dog agitates the group, and the alpacas storm their enclosure and stampede over your property, leaving a trail of damage in their wake. While […]

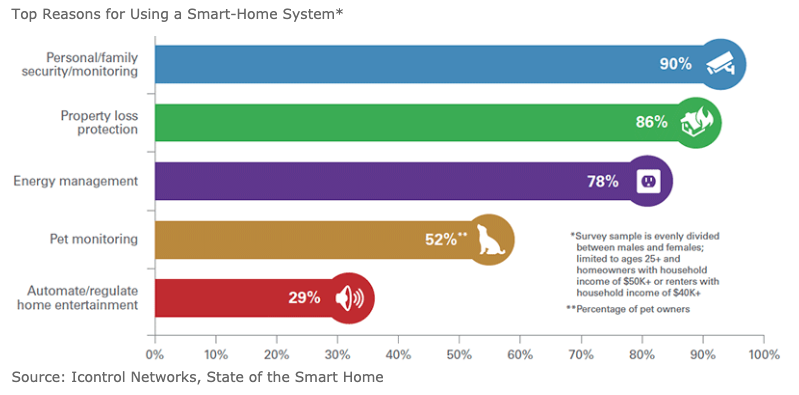

How Smart Home Technology is Influencing Home Insurance

By now, most Americans have grown accustomed to smart devices. Whether it is a smartphone or a smartwatch, we interact many times a day with some sort of smart device. These gadgets have changed the way we live providing unprecedented convenience and productivity. Smart devices in the home are no different. Over the last few […]

10 Facts You Should Know About Weather-Related Home Insurance Claims

Weather-related home insurance claims can be a whole separate ball game from other home claims. “Weather losses are always more complicated because you’ve got thousands of people experiencing losses at the same time. These events are taxing on the entire community, whereas if you have one loss, such as a water main break in your […]

Mudslide vs Landslide: What’s the Difference?

Picture the scene. Massive trees have fallen, downed electricity poles, damaged cars and other materials scattered on the ground. Every year, in all areas of the United States, both mudslides and landslides occur, leaving devastation and destruction in their path. Cincinnati regularly sees mudslides along Columbia Parkway and within the past few years, a landslide […]

What You Need to Know About Flood Insurance

Flood insurance is an important policy for most homeowners to have. But only about one in seven homeowners purchase this critical safety net to protect them from the ravages of flood water. What is Flood Insurance? Flood insurance is a specialized policy that protects your home and belongings against damage from flood waters. If you’re […]

Climate Change May Affect Your Homeowner’s Insurance Policy in Two Ways

You only need to watch the news once to understand that weather events have become more dramatic over the past 10 years. According to Maryland State Insurance Commissioner Al Redmer, whether you’re talking about tornadoes, floods, hurricanes, or wildfires, “Both the number and severity of natural disasters have increased” – and so have the number […]

How Smart Home Technology is Influencing Home Insurance

By now, most Americans have grown accustomed to smart devices. Whether it is a smartphone or a smartwatch, we interact many times a day with some sort of smart device. These gadgets have changed the way we live providing unprecedented convenience and productivity. Smart devices in the home are no different. Over the last few […]

Here’s What You Need to Know About Airbnb-ing Your Home

Sally Miller left corporate American when her first child was born to spend time with her growing family. But this also meant the family income took a hit, so she started exploring ways to make money from home. Hosting her four-bedroom home in San Jose, California on Airbnb turned out to be a great side-gig. […]

Climate Change May Affect Your Homeowner’s Insurance Policy

You only need to watch the news once to understand that weather events have become more dramatic over the past 10 years. According to Maryland State Insurance Commissioner Al Redmer, whether you’re talking about tornadoes, floods, hurricanes, or wildfires, “Both the number and severity of natural disasters have increased” – and so have the number […]

3 Types of Water Damage

Is Your Home Insured For Water Damage? Water is one of the most common causes of damage in homes, and it represents a large number of insurance claims. Water damage to your property can happen from any number of sources: Plumbing or Appliances Severe Weather or Storms Accidents Infiltration Causes of Water Damage in Insurance: […]

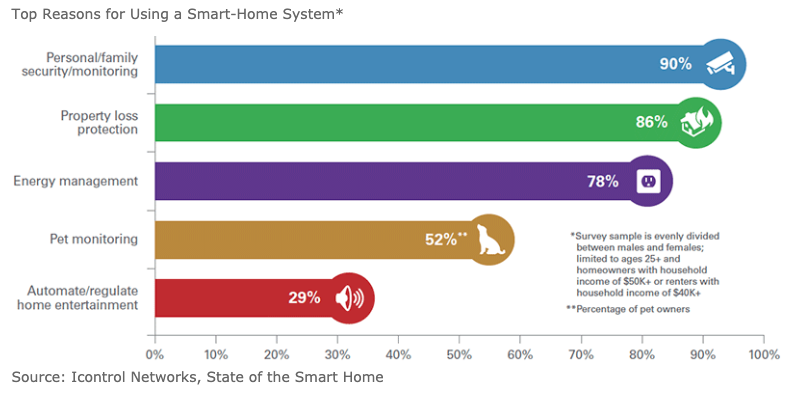

Homeowners Insurance: Premium, Policy Limits and Other Home-Related Insurance

Premium Many factors influence your premium and it will also vary by insurance company. An independent agent can help you shop for the best price without compromising your coverage. Some of the things that can affect your premium include: The cost to rebuild your home (this is not the same as the purchase price which […]

Unoccupied and Vacant Home Insurance: What is it and Do I Need it?

If you leave your home unattended for weeks at a time, your homeowners policy likely won’t provide coverage in the event of a claim during the time it is unoccupied or vacant. As a result, any damages or losses that occur would have to be paid out of pocket. For these times, unoccupied and vacant […]

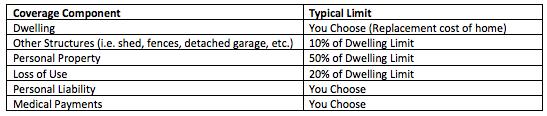

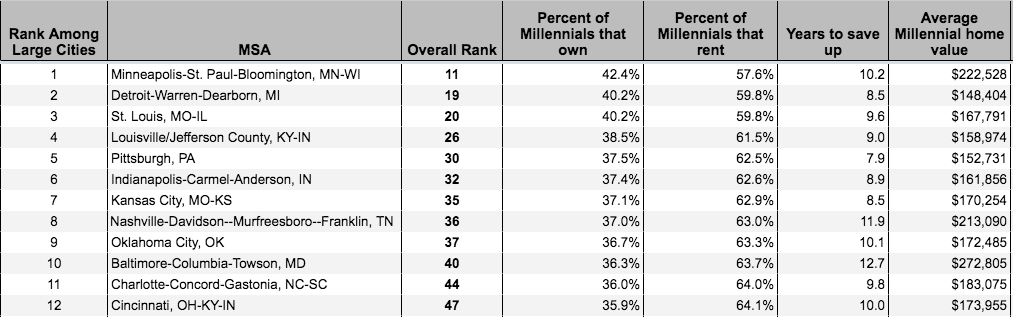

Renters No More: Millennial Home Buyers

According to Primary Residential Mortgage Inc., Millennials are currently the largest class of homebuyers in the market. It may come as a surprise to some, but this young, tech-savvy generation is still set on finding a home, even during a volatile market with rising interest rates and fewer homes on the lower end of the […]

Flooding: Know Your Risk

What Flooding is an overflowing of water onto land that is normally dry. Floods can happen during heavy rains, when ocean waves come on shore, when snow melts too fast, or when dams or levees break. Flooding may happen with only a few inches of water, or it may cover a house to the rooftop. […]