It is often said that smartphones are more powerful than the computers used in the NASA 1969 Moon landing mission. The 2KB memory of the Apollo 11’s guidance system is tiny compared to today’s Apple or Android handsets.

When coupled with always-on internet access, these devices open up a world of possibilities – but many consumers never give their sophistication a second thought.

Technology has become so ubiquitous, it is hard to live without it. It comes with huge advantages, but also risks – and there is an increasing role for insurers to play in protecting customers in the face of cyber threats.

Besides being able to shop whenever and wherever, as well as stream movies and music, the digitization of the personal space has many other, more tangible, benefits too. Globally, more than three quarters (76%) of account-owning adults make digital payments and rely on online banking to meet other day-to-day financial needs, such as checking balances.

For millions of people in emerging markets, managing money via a mobile phone has become a lifeline. It has made it possible to send money to friends and family thousands of miles away or make payments for business transactions. These and many other everyday activities would be practically impossible for many people living in remote parts of the world, hundreds of miles away from the nearest bank.

Rapid advances in technology are enabling new services all the time. Smart doorbells let you see who is at your doorstep via an app on your phone. Smart heating and lighting controls let you change the temperature and switch lights on or off remotely. And smart energy meters help you monitor your energy usage and costs in real-time. All such devices are part of the Internet of Things (IoT), meaning they are connected to and send information via the internet, enabling them to be controlled by phone, tablet, or PC.

It may already feel like we live in an interconnected world, but the reality is we are still only in the early days of this new wave of expanded digitization. There will be an abundance of opportunities to come, but that will also mean a greater need for risk awareness and mitigation.

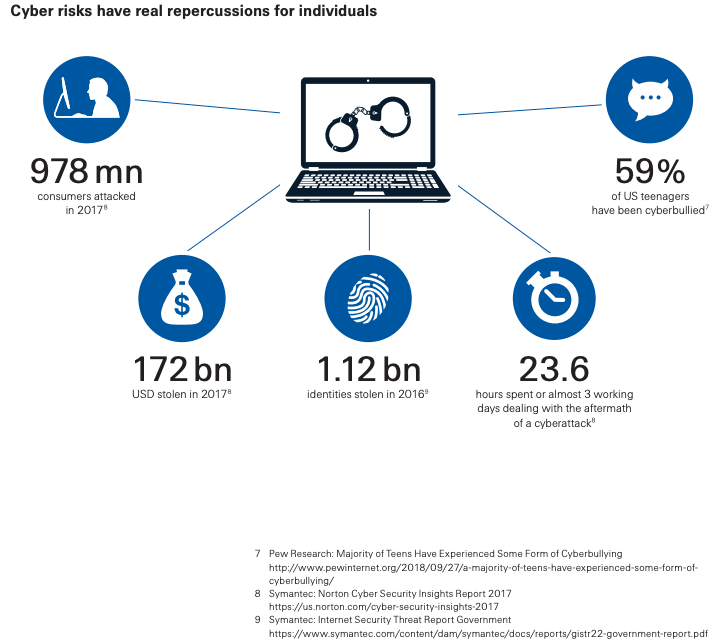

Emerging Cyber Risks for Individuals

There is always an element of risk in all everyday online activities. But the manner in which individuals conduct themselves online can determine whether they expose them to active threats. That might relate to storing credit card details on a retailer’s website or sharing sensitive personal data via an unprotected wireless network, or non-encrypted websites. But in our increasingly connected world, the risk does not stop just because you switch off your computer or put down your smartphone. It has been predicted that by 2030 there will be around 125 billion IoT devices globally, which represents a huge potential for cyberattacks.

The chances of your smart doorbell or connected fridge being targeted by hackers are relatively slim. However, the more commonplace devices like these are, the greater the inherent risk becomes too. Partly, this could be down to a lack of awareness and understanding of what smart devices are and how they function – does everyone with a connected device stop to think about how secure or otherwise that might be?

In recent years, the phenomenon of ransomware has become a particularly high profile cyberthreat. Such attacks follow a broadly similar pattern, whereby a website or other online system will be taken over by an attacker who locks the legitimate owner out and demands a ransom. Although it is typically attacks on businesses that have made the headlines, anyone can be a ransomware target.

There are other attacks that target individuals more specifically, and which can have profound and distressing consequences.

If a person’s bank details are compromised or stolen it can be the start of a series of problems that go far beyond unlawful withdrawal of funds: identity theft. In addition to possibly clearing your accounts out, crooks may use your personal information to open bank accounts or take out loans in your name. While fraudsters abscond with their ill-gotten gains, the individual whose identity has been cloned will be left with the fallout. Frequently this will involve payment default notices and a damaged credit record all of which may only come to light several months after the fraud was perpetrated.

The emotional and psychological harm of falling victim to identity theft can be profound and is not the only example of how our digital lives can start to impact on our overall wellbeing. Cyberbullying and stalking have become all too common parts of everyday life for far too many people, with more than half of US teenagers saying they have been bullied or harassed online.

From identity theft, to hacking of subscription and IoT home devices, the list of cyber risks people, and not just organizations, are facing is growing all the time as the cyber threat landscape metastasizes rapidly.

How Consumers Can Respond to These Threats

There are steps every individual can take to protect themselves from these risks. Taking responsibility for one’s personal cybersecurity and learning good habits are critical first steps, as are:

- Using unique passwords for every account and choosing passwords that are difficult to guess.

- Having up-to-date security software as well as running automated software updates.

- Ensuring home IoT devices have security in place.

- Banking and shopping via websites with extra security in place like ‘https://’.

- Only opening email attachments if they come from recognized contacts, and never giving out personal information, logins or passwords in response to emails purporting to come from banks or other organizations.

- Regularly backing up valuable data like work files, music, photos and storing it safely.

But even the most vigilant and online-savvy people will never be entirely risk-free. This is where personal cyber insurance can help mitigate the risk and transfer the potential for loss from that residual risk. Although not yet widely available, personal cyber insurance is expected to become a fast-growing market segment in the near future due to the rapidly increasing exposures consumers face today. The benefits of such an insurance product to individuals and families can range from support in improving people’s cyber security posture to financial compensation and expert help in the aftermath of a cyber incident.

Source: SwissRe