As a business owner, there will likely be a time when you host or organize a special event for employees and/or clients. In doing so, you want to ensure that you and your company are protected against anything that can go wrong during the event. The size of an event can range from small to large and given the scale, you will want to make different preparations to ensure that your event runs smoothly.

When hosting or organizing a special event, you will want to make preparations for live performances, catering, vendors, alcohol services, keynote speakers, so on and so forth. For each of these different aspects, you want a specific type of coverage. Special Events Insurance provides you with the peace of mind in knowing that you and your business are protected and can enjoy the event.

What Special Events Insurance Is All About:

What is Special Events Insurance Coverage?

Special Events Insurance is a type of insurance that provides coverage for the different types of issues that can arise throughout the course of a special event. If you plan to have alcohol at your event, you will want to ensure that you are protected against the many consequences that can occur when people drink. Insurance means that you and your business are covered in the event a guest drinks too much and drives home, causing themselves or someone else bodily injury and/ or damages to vehicles.

If you have hired a caterer or live performer, you will want to make sure you are covered in the event of cancellation and able to find an alternative. Similarly, if the location itself suddenly does not work out, you will need to find another spot for your event and want financial protection for last minute changes. This insurance protects against anything that can go wrong with services and equipment.

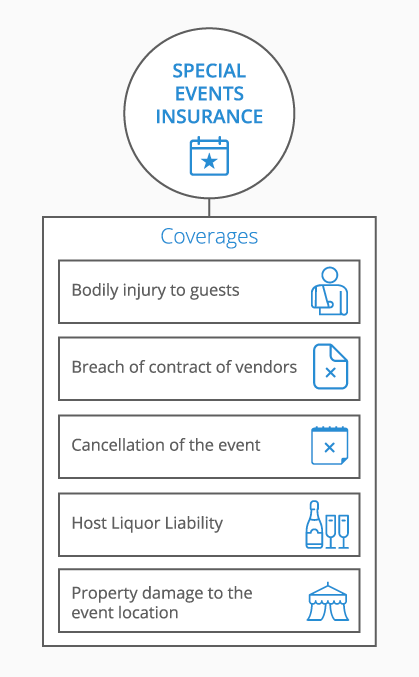

What Does Special Events Insurance Cover?

- Rental Coverage: Covers any equipment rented from the venue or rental house. Covers damage to the equipment or replacement cost if a total loss.

- Third Party Property Coverage: Protection for the location which is rented for the special event.

- Personal Injury Coverage: Protection against claims of slander and libels, false arrest, malicious prosecution, wrongful eviction/wrongful entry, oral or written slander.

- Employers Liability Coverage: Protection against bodily injury to employees.

- Vendors Coverage: Covers damage to property of the venue by the contractor.

- Host Liquor Liability: Protection in case of alcohol-related accidents.

- Cancellation Coverage: Protection in case of the need of cancellation.

- General Liability Coverage: Contractors such as performers, actors, etc. covered under General Liability for losses due to bodily injury or own property damage caused by the contractor.

- Umbrella Liability: Additional coverage above the standard 1,000/2,000k.

- Hired & Non-Owned Auto: Covers rented vehicles used for the event as well as coverage for vehicles being used to unload equipment.

Who is Covered by Special Events Insurance?

Do I Need Special Events Insurance?

If you are the host or organizer of an event, investing in Special Events Insurance is critical. The larger the event, the more important obtaining this insurance becomes. You want to ensure that everything going into an event is protected and that if something comes up, you can find a solution quickly and efficiently. Without protection, you may find yourself stuck facing a last-minute obstacle and tasked with going over budget making alternative arrangements.

You want to ensure that things run smoothly for your employees and clients during an event. Additionally, you also want to protect yourself and your business against anything that occurs during the event itself. Someone may drink too much and get into a fight. The caterer might not have warned guests of allergens in the food. Equipment may malfunction and halt important presentations. In every situation, this insurance will come in handy.

This insurance will come in handy if:

- You are the host or organizer of a special event and want to protect yourself and your business against unwanted outcomes.

- You are the host or organizer of a special event and want to protect your guests and your clients against unwanted outcomes.

- You are the host or organizer of a special event and want to protect the location of your event against damages.

- You want to ensure your business assets are protected for now and for the future.

- You want coverage that covers the specific aspects of your individual event including alcohol and food services, live performances, equipment and more.

What Are the “Limits” on a Special Events Insurance Policy?

A special event policy covers specific types of protections in addition to what your General Liability Insurance covers. Each of these protections will have coverage upwards of a given amount. If your policy provides coverage upwards of $1 million, then this will be the limit. As the types of coverage needed for Special Events vary greatly, each will have a different amount. If you choose a policy that does not cover the full value, then you will be protected upwards of a given amount.

In addition to that, Special Events Insurance can provide your business with the coverage needed to host or organize a successful special event. In doing so, you can focus more on enjoying the event itself than worrying about something going wrong.

You’ll Know It’s the Right Policy If…

- It covers damages to the location where your special event is being hosted.

- It offers protection for the equipment you use during the event.

- It protects your business in the event that a guest or anyone else hurts themselves at your event.

- It offers protection for your business in the event that a guest drinks too much and causes a car accident.

What Does Special Events Insurance Not Cover?

How Much Does Special Events Insurance Cost?

The costs associated with Special Events Insurance vary in accordance with the specific policy you have chosen. Each policy is created based on the specific aspects of your event. The scale of the event will be a determinant of the types of services necessary to be contracted. Each type of contractor on site will need a specific type of coverage. Special Events can range from a small private employee or client appreciation party to a corporate funded festival. Some events may have food while others don’t. Events with alcohol have specific liabilities that may require a greater amount of coverage.

Overall, the cost will be contingent upon the type of the insurance policy you choose and how much protection it affords. You may choose a policy that includes one, several or all of the aforementioned protections, each of which have their own costs. Regardless of the protections, you invest in; you will likely find yourself paying a small percentage of that amount in the form of a premium.

Source: Coverwallet