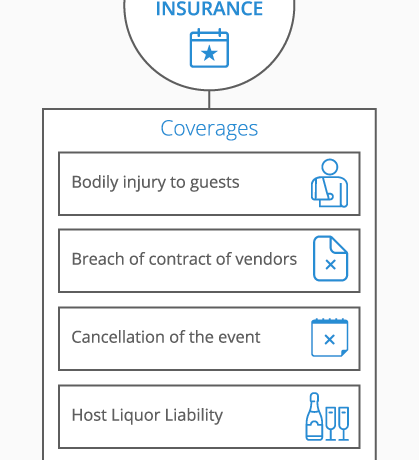

As a business owner, there will likely be a time when you host or organize a special event for employees and/or clients. In doing so, you want to ensure that you and your company are protected against anything that can go wrong during the event. The size of an event can range from small to […]

Should You Seek Out Umbrella Insurance?

Your son blinds a playmate with his BB gun. Your daughter rear-ends a car, causing serious injuries to its driver. A neighbor breaks his neck by diving into the shallow end of your swimming pool. Your teenager’s friend drinks liquor at your house, then paralyzes another driver in a car crash. You serve on the […]

Does Your Business Need Commercial Umbrella Insurance?

When you hear the term “commercial umbrella insurance,” what comes to mind? Many business owners aren’t entirely aware of what this type of coverage entails, or even what it means. Today, we are going to give you the answers to your most pressing questions on the topic! What is commercial umbrella insurance? Commercial umbrella insurance […]

What’s Covered by Umbrella Insurance?

Homeowners insurance protects you if, say, a fire burns your house to the ground. That’s a start. But you also need to think about protecting your home against something equally dangerous: a lawsuit. If a houseguest slips in the bathtub, you could get sued. Lose the lawsuit and you could lose all of your assets, […]

What is Commercial Umbrella Insurance?

Commercial umbrella coverage gives you extra liability coverage to help pay costs that exceed your general liability or other liability policy limits. Without this business insurance coverage, you’d have to pay out of pocket for expenses that cost more than your coverage limits, such as: Legal fees Medical bills Damage expenses A commercial umbrella policy […]

Umbrella Insurance is the New Liability Coverage

It seems as though the wealthier an individual is, the higher the risk of being sued. It’s just one of the downsides of being affluent, especially if that person is also a business owner. In opportunistic lawsuits, primary policies like standard car insurance, home insurance and a business owner’s policy do not fully protect a […]

Everything You Need to Know About Crop Insurance

Crop insurance protects farmers and agricultural producers against the loss of crops as a result of extreme weather, like floods, hail, and drought, or the loss of revenue due to price fluctuation in the agricultural commodity market. There are two types of crop insurance available to farmers in the U.S. : crop-hail insurance, which is […]

5 Things to Know About Umbrella Insurance

1. Without it, You Could Lose Everything If you cause a car accident and the other driver sues, your auto insurance covers you up to your personal-liability limit, which is likely between $100,000 and $300,000. Same goes for your homeowners insurance if the mailman slips on your steps. An umbrella liability policy pays for settlements […]

Commercial Umbrella Insurance: What You Need To Know

The term “umbrella insurance” is a good descriptor – it’s a broad type of coverage used to protect your business from liabilities that threaten its financial stability. This insurance extends over other policies to provide additional coverage when certain kinds of underlying policies have reached their limits. It also can kick in to fill in […]

Umbrella Insurance – What Is It, And Do You Need It?

One of the best things about living in America is the right to a fair trial if you’re accused of wrongdoing – and the right to bring someone else to trial if they wrong you. It can also be one of the worst. The right to due process is crucial to any free society, but […]

Umbrella Insurance 101

Umbrella Insurance is a form of liability insurance that will supplement your basic liability policies, such as your auto, home or renters insurance. An umbrella liability policy covers a much higher limit and goes above and beyond claims directly relating to your home and auto. The main purpose of your umbrella policy is to protect […]