Unlike homeowners, condo dwellers don’t own the building they live in or the land it sits on. Your condo or homeowners association (HOA) will carry a master policy to insure the building and pay for accidents that occur on the property outside or in the common areas.

However, your HOA might not pay to repair the inside of your unit after disasters, nor will it replace your damaged or stolen belongings or cover liability costs if guests are injured in your condo. That’s why it’s smart to protect yourself with personal condo insurance, also called an HO-6 policy.

HOA vs Condo Insurance

To better understand how individual condo insurance and your HOA’s master policy differ, here are common instances when each coverage typically kicks in.

When You Need Condo Insurance

- There is damage to the interior of your unit. As a condo owner, you don’t own the building. But you do own your unit, often including fixtures such as lighting, cabinets and appliances. Whether you need to insure your unit’s interior comes down to what kind of master policy your HOA carriers. If the HOA has what’s known as an “all-in” HOA policy, it typically will cover all the original items built into your place, like the aforementioned cabinetry, lighting and other fixtures, plus things such as plumbing and wiring. However, if the HOA has what’s called a “bare walls” HOA policy, it’s up to you to insure everything in your living space besides the walls, floor and ceiling.

- Your belongings are stolen. The HOA’s insurance won’t cover your belongings, such as furniture, computers and clothing. You’ll need to file a claim through the personal property coverage on your condo insurance if your possessions are damaged or stolen.

- A guest gets hurt in your home. If a visitor trips and falls on a staircase inside your unit, personal condo insurance can help cover his or her medical bills and your liability costs if you’re sued.

- You can’t live in your condo due to damage covered by your policy. If fire damage or another issue covered by your personal condo insurance policy makes your unit uninhabitable, the insurer will pay for expenses related to living elsewhere, such as hotel room bills.

- The damage exceeds the HOA’s policy limit. If your HOA surpasses the limit of its master policy – say, repairing major hail damage to the building – each unit owner might need to contribute funds to make up the difference. If you have “loss assessment” coverage on your condo insurance, this sum may be partially or totally covered.

What HOA Insurance Is Typically Responsible For

- Damage to the building exterior. Condo owners usually aren’t responsible for, say, repairing the roof after a storm, fire or other disaster.

- Damage to common areas and shared amenities. Common areas generally fall under the HOA’s jurisdiction, including the land outside the building, tennis courts, lobby, elevators and hallways.

- Injuries guests sustain in common areas. If a visitor is injured on an icy walkway outside the front door to the building, your HOA’s insurance covers the liability costs in case of a lawsuit.

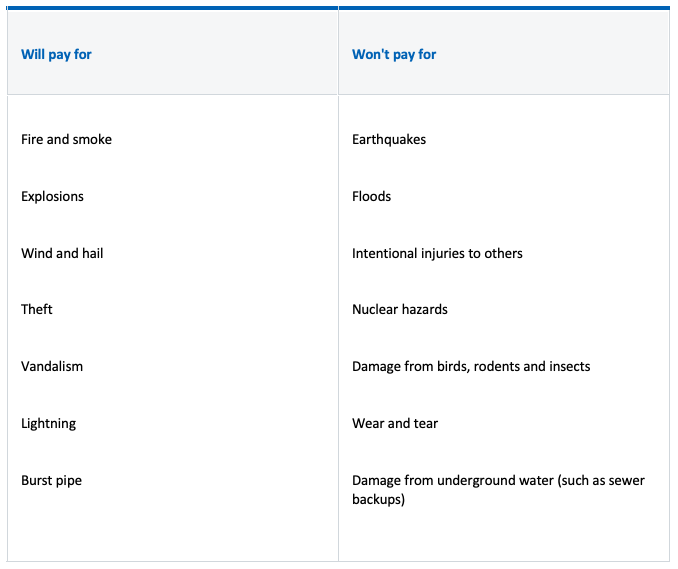

What Condo Insurance Does and Doesn’t Cover

Below are some of the common problems that are and aren’t included under a typical condo insurance policy.

How Much Condo Insurance Costs

On average, condo insurance costs roughly $100 to $400 per year, according to TrustedChoice, a group of independent insurance agents. However, your exact rates will depend on a variety of factors, including:

- Where you live.

- Construction materials used for your condo.

- How much your HOA’s insurance covers.

- Coverage options and limits you choose.

- Your deductible amount.

How Much Condo Insurance to Buy

To figure out the amount of personal property coverage you need to replace all of your stuff, take a home inventory. That can be a lot of work, but you can use an inventory app to help. When it comes to the interior of your unit, review your HOA’s master policy before deciding on the amount of your condo insurance.

Some HOA plans may cover the original cabinetry, lighting and other fixtures in your unit, for example, meaning you’re responsible only for damage to renovated areas. If that’s the case, you may feel comfortable selecting lower amounts of physical damage coverage. Other HOA policies won’t cover anything inside your walls, even plumbing and wiring, meaning you need to add more items into your coverage calculation.

It’s difficult to make a blanket recommendation about condo policies because state laws and HOA bylaws differ from case to case. Talking with a licensed insurance agent is the best way to get coverage suggestion for your situation.

Article By: Alex Glenn

Source: Nerd Wallet

Leave a Reply

You must be logged in to post a comment.