The Essential Information You Need to Buy the Best Condo Insurance Do you own a condominium (condo) or co-operative apartment (co-op) or are you thinking of buying one? Insurance for co-ops and condos is a lot more complicated than homeowner insurance. A lot of people invest in condos without understanding the full implication of their responsibility, or they […]

Your homeowners policy may address your condo special assessment. But don’t expect coverage in all cases.

Q: You recently wrote a column about condominium building’s reserve funds. You failed to mention that condo special assessments are an insurable risk. I just increased my coverage from a limit of $1,000 to $50,000 for an extra $10 per year. You should mention this to your readers. A: Thanks for bringing this up. You are […]

Insuring a co-op or condo

Because co-op and condominium owners share their building structures, two policies—a master policy and an individual policy—are required to fully protect all parties involved. Learn more about insuring a co-op or condo. If you are purchasing a condo or co-op, the bank will require insurance to protect its investment in your home, and your co-op […]

Insurance Facts for Condo Owners

While condominium units belong completely to their owners from their unit walls inward, their exteriors are usually communally owned. Condominium communities feature joint ownership of building exteriors, roads and other common areas by all unit owner-members of those communities. Because condo units share aspects of their legal ownership with other parties, their insurance requirements differ […]

What Is Condo Insurance?

If you own a condominium, co-op, or townhouse unit, you may need to buy a condo insurance policy. Much like homeowners insurance, condo insurance can protect your dwelling, furniture, clothing, and valuables in the event of a covered peril or hazard. It can also protect your assets from liability claims and pay for temporary housing […]

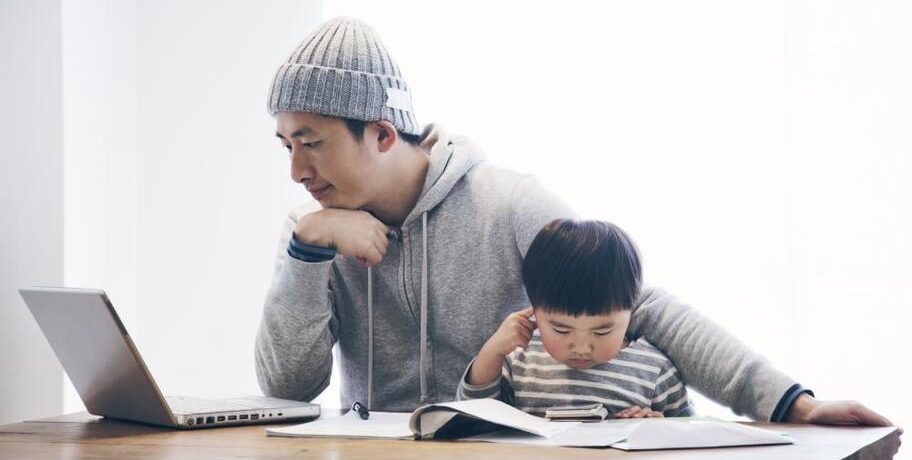

Home-Based Business Insurance Explained

With millions of Americans losing work this year, it’s not surprising that home-based business startups are gaining popularity. About one in five homeowners reported they had launched a home-based business in the last six months, according to a recent online poll conducted by The Harris Poll on behalf of The Hanover Insurance Group. While starting […]

What Type of Insurance Does Your Home Business Need?

For many small business owners, working from home is a dream come true. However, this is a dream that comes with its own set of sometimes-unexpected problems and considerations. As an entrepreneur, some challenges – like needing to efficiently manage your own time and wear multiple hats – are probably already on your radar. What […]

Home-Based Business Insurance: Who Needs It?

If you own a home-based business or you’re thinking of starting one, you’re in good company. According to SBA statistics, Americans own about 28.8 million small businesses—and half of them are at-home businesses. The most common types of home-based businesses include information, construction, and professional service firms. But today’s entrepreneurs are getting creative, turning some serious […]

Does Your Home-Based Business Need Business Insurance?

If you’re one of the growing number of entrepreneurs with a home-based business, you may have pondered getting business insurance. But it’s not just a case of whether or not to get insured, but what kind of insurance to get. These days, many successful entrepreneurs and small business owners operate their businesses from the comfort […]

Everything You Need to Know About Special Events Insurance for Your Wedding

We’re certain that purchasing wedding insurance wasn’t one of the first things on your to-do list after you got engaged—after all, it’s not the most romantic of subjects. However, if there’s anything we’ve learned over the years, it’s to expect the unexpected. Putting on an event of this scale is not only a financial investment but […]

Special Event Insurance for Nonprofit Organizations

Many nonprofit organizations (NPOs) rely on events to raise money. But great events come with great responsibilities, and possible liabilities. Whether your nonprofit holds an awareness walk, a fundraising dinner, or a community concert, risks are always present. If your nonprofit organization regularly holds special events, it’s important to manage the potential perils that could financially impact […]

5 Reasons Why Travel Insurance Is a Must

If you’re like us, here’s how you prepare for a big trip: You pack way too much, realize your suitcase won’t close, then start taking stuff out. The snorkel gear, the sarong, that second jacket… you don’t really need those. But there is one thing you definitely, absolutely need to pack: Travel insurance. A lot of people […]

A Complete Guide To The Best Special Event Insurance

There are many different types of events—everything from weddings to parties to conventions and corporate meetings. They generally can take months of planning and cost a lot of money. While everyone hopes their event is flawless, event planning is complicated and there are many things that can go wrong. Having comprehensive special event insurance can help protect you financially in situations where things go south. What is Special Event Insurance? Special event […]

These 5 Wedding Insurance Policies Top Our List

Of all of the things you need to purchase for your big day, most wedding professionals will tell you that wedding insurance is at the top of their list. While wedding insurance comes in several forms, the overall concept is that it protects the host against any financial issues that could arise from extenuating circumstances. But […]

RV Insurance: Everything You Need to Know About Insuring Your RV

Owning an RV is an exciting thing that opens up your world to endless possibilities for adventure. As tempting as it can be to hit the road right away, it’s important to make sure you’re adequately protecting yourself and your investment from the hefty price tag that can come from an accident. That’s right— we’re […]

Importance of Motorcycle Insurance and What Coverage You Need

Motorcycle accidents can cause very serious injuries to motorcyclists. Unfortunately, many bikers learn that they lack adequate coverage after they are seriously hurt in an accident. By being aware of the importance of this insurance and by taking steps to acquire the necessary coverage, motorcyclists may be able to avoid some of the tragic consequences […]

The Basics of Boat Insurance

If you have a boat, you know nothing is like the warm sun and cool breeze on the water. You probably cherish the memories you make out on the water, which makes it all the more reason to protect your boat with the right insurance. Purchasing boat insurance can give you and your passengers peace […]

If You Own or Rent an RV, You Need Insurance. Here’s Everything You Should Know About It

If you love to travel, you may be thinking of joining the millions of Americans who own an RV—and the many more who rent one occasionally. And if you want to live a nomadic lifestyle, you might be considering swapping your house or apartment for a home on wheels. In either case, you will need insurance. […]

2021 Natural Catastrophe Losses From Major Events Reached $56.92B – Here’s Why

When a natural catastrophe hits a community, there can be significant long-term impacts. When a large portion of the local population leaves the area during the rebuild process, local economies struggle, contributing to job displacement and the destruction of real estate and other assets. And even after reconstruction efforts are completed, the financial and social […]

Roof Inspection Tech Could Speed Claims Process, Prevent Loss

In the aftermath of a storm, the roof may not be the most appealing place to venture, but it’s integral it be inspected quickly for damage. Even when the weather is fair, it’s important to regularly monitor the state of your roof in order to provide proper maintenance and prevent unnecessary loss. This type of inspection is costly in […]