Why We Love Wedding Insurance (and You Should, Too!)

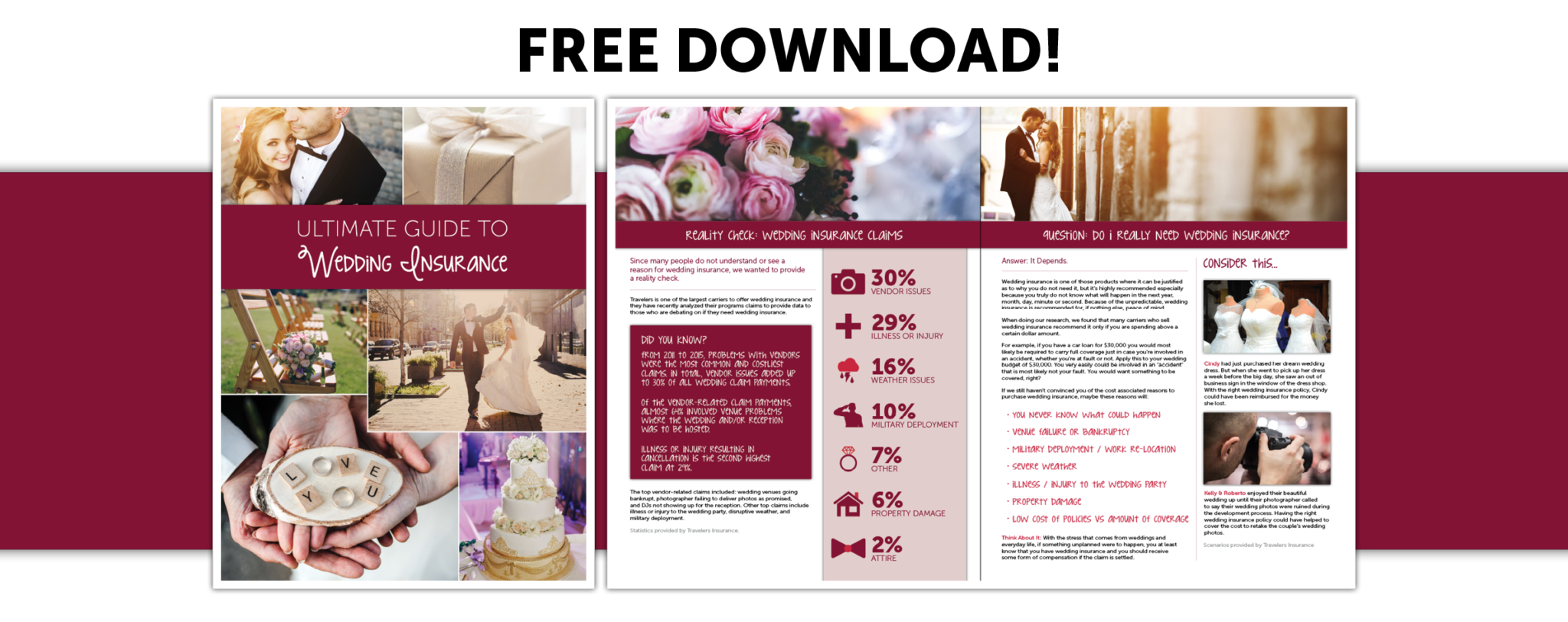

Wedding Insurance. What is it exactly and do I even need it? Our guide will try to explain the ins-and-outs of wedding insurance and the reason you and your future spouse should consider purchasing it. While wedding insurance can be seen as a luxury line of insurance, there are very strong reasons as to why it should be purchased. Make your way through our Ultimate Wedding Insurance Guide to discover what it is and why you should consider purchasing it.

To gain a better understanding of our topic, we asked several bride-to-be’s what they think wedding insurance is:

“

We don’t have wedding insurance, but I think I have heard of it. I have no idea how it works exactly, but my best guess is that it is like a pre-nuptial. Essentially, it works as a fall back plan in case the couple breaks the engagement after they have booked and put down deposits on the venue, church, dress, rings, etc. This may be something separate but Brad did get my ring insured when he bought it. In case it ever gets lost or damaged, I can get it replaced.” – Cecilia K.

“I have never heard of wedding insurance.” – Katie H.

You can see from these examples, some people who are planning a wedding within the next year, have no idea why they should be considering wedding insurance.

Wedding Insurance Coverage

There are so many components to a wedding that the engaged couple might be left thinking, what will wedding insurance cover?

While it does vary by company and sometimes a case-by-case basis, most wedding insurance policies offer coverage for the following items:

- Venue: This includes the site of the wedding, reception, and at times, the rehearsal dinner.

- Weather: This includes cancellation due to damage or inaccessibility caused by weather.

- Vendor: This includes vendor cancellations, postponements or lost deposits due to business closure.

- Sickness / Injury / Death: This includes postponement due to sickness, injury, or death to anyone that is essential to the wedding.

- Military / Work Relocation: This includes cancellation or postponement due to military deployment or work relocation.

- Unemployment: This includes coverage if a bride or groom is suddenly unemployed and must cancel or postpone the wedding.

- Stolen Goods: This includes any items that are stolen, lost or damaged.

- Attire: This includes any attire based element for the wedding party that is stolen, lost or damaged.

- Photography: This includes coverage for any photos or videos that are lost or destroyed. This also covers if a photographer does not show up for the event.

Some carriers can even offer wedding insurance add-ons which can include liquor liability, higher limits for larger weddings and other additional items. Check with your agent today to see what their carriers offer and never hesitate to ask questions.

Cost of Wedding Insurance

When couples are budgeting for their wedding, if they don’t think wedding insurance is a necessity, they might leave it out.

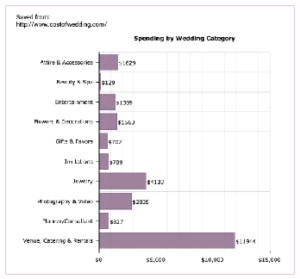

On CostofWedding.com, couples can estimate the cost of their wedding based on factors specific to them and their location. Here, we are highlighting the average wedding category expenses in the United States of America (chart on right, click to download a PDF).

Did You Know?

The average wedding cost is $26,645, not including the cost of the honeymoon.

When creating your wedding budget, if you add a couple hundred more dollars, you could save yourself from losing a large sum of money if the unpredictable happens.

Wedding insurance can help you receive compensation for essentially any claim that could occur including lost deposits (depending on the coverages). Ask your agent for specific details when obtaining a quote.

Questions to Ask an Agent

Before making the decision to buy wedding insurance from an agent, there are a few questions you should ask. By asking these questions, you will be able to determine if the agent you have contacted can truly help you with your wedding insurance needs:

- Are you a licensed agent in the state of [insert state of residence]?

- Are you able to sell wedding insurance in [insert state of residence]?

- Are you able to provide a quote for wedding insurance before I purchase?

- How much reimbursement can I expect if a loss occurs?

- What is covered & not covered by the policy? [Ask for specifics.]

Another option to help you find a reputable agent for wedding insurance is by searching on Trusted Choice. This website lists agencies close to your area who are independent agents. You can also search by type of insurance so you can streamline the list to your specific needs.

Sources: The Knot, International Risk Management Institute, Insurance Information Institute, Bankrate, BrideBox

Leave a Reply

You must be logged in to post a comment.