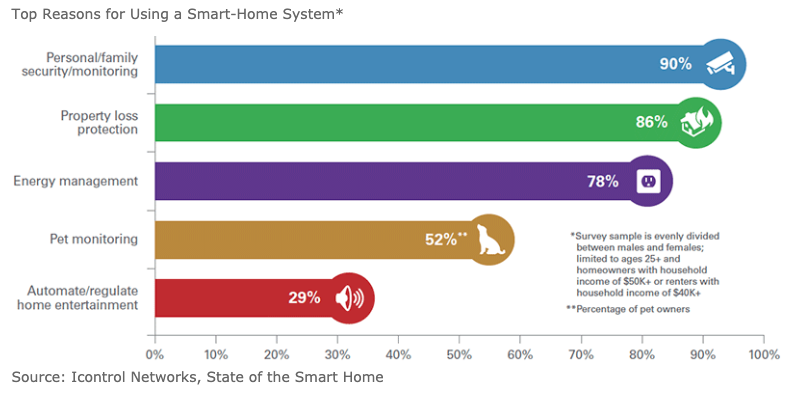

By now, most Americans have grown accustomed to smart devices. Whether it is a smartphone or a smartwatch, we interact many times a day with some sort of smart device. These gadgets have changed the way we live providing unprecedented convenience and productivity. Smart devices in the home are no different. Over the last few years, smart home devices and the internet of things (IoT) have grown from novel to mainstream. In fact, Allied Market Research expects the “Smart homes and buildings market to reach $35.3 billion, globally, by 2020.” Smart devices in the home do provide some convenience and productivity, but the consumer’s primary motivators are security and protection. If this is true, then home insurance companies must be equally interested in the implementation of smart home devices. To understand the relationship between the smart home industry and home insurance, we must analyze the benefits of smart home devices, along with the potential risks of their adoption.

Benefits of Smart Home Devices

First, let us consider several of the smart home devices on the market and the ways each device enhances home security and protection. By understanding these benefits, we can better understand why these devices are important to home insurers. Note that this list is not comprehensive, but rather intended to highlight a few important smart home devices.

- Early detection of water usage anomalies – the integration of water usage sensors with automated water valves allows homeowners to know if a leak exists and then take immediate action by automatically turning off the water. Without this type of smart device, a homeowner is dependent on visual indicators of a leak. Once there is a visual indicator, however, the damage is going to be more significant.

- Smoke detection and interpretation of smoke alarms – smart smoke alarms can prevent false alarms by interpreting the smoke data to indicate the likely source of the alarm. Another benefit relates to the connectivity of these devices. If the homeowners are on vacation and the alarm activates, then they will know immediately, instead of finding out after the fire department shows up or even worse after returning from vacation. This benefit significantly reduces the potential and severity of a claim.

- Water damage and humidity indicators – moisture level sensors can help homeowners know if conditions exist that could lead to mold build up. These sensors also assist in the event of actual water damage sustained during a storm or rain event.

- Doorbells, locks, cameras – security and vandalism protection are primary goals of devices such as smart doorbells, locks and cameras. These devices allow users real-time activity of their homes.

- Water saving devices – smart devices that monitor water use can help to ration water use in areas where water is scarce. This can also assist during periods of drought.

- Freeze detection indicators – these devices help homeowners know if their pipes are at risk of freezing so they can take appropriate prevention action.

- Appliance/electrical monitoring – smart devices allow homeowners to control appliances, plugs and lighting remotely. This can prevent the potential of a loss if an oven remained on after the homeowner left the house.

Home Insurer Interest

As evidenced by the above list of home security and protection enhancements, home insurance companies could significantly reduce their exposure to a loss and its severity by having homeowners implement smart home devices. Home insurance underwriters use predictive analysis to determine insurance rates based on a limited number of general factors. By implementing smart home devices with their insureds, home insurance underwriters have a plethora of data to help in developing a more accurate prediction of potential losses.

Furthermore, since these devices aid in loss prevention and engagement of homeowners in the home protection process, home insurance companies should be all-in on smart home devices. In fact, below is a timeline identifying the increasing development of insurer/IoT partnerships. Should insurance companies even issue their insureds a basket of smart home devices to use in order to reduce the risk of loss? While this sounds ideal, there are risks to consider when it comes to depending on smart home devices.

Risks of Smart Home Devices

First is privacy. A homeowner may want to use a smart device in their home, but not want to share the data with an insurance company, even if it means forgoing lower insurance rates. Due to the prevalence of data scandals, i.e. Facebook, Cambridge Analytica, many consumers are wary about sharing personal data, especially when it is personal and relates to the intimacy of a home. Insurance companies must find creative enticements to help get past this barrier, as evidenced below.

Another risk relates to the early adoption of certain smart home devices. Insurance companies have an opportunity to partner with smart home device producers or risk being left behind. In a similar vein, an insurance company must have comfort that a particular device is going to be effective and useful in the long term. As the industry grows, consolidation of devices will continue and certain brands may become obsolete.

Perhaps the most significant risk revolves around cybersecurity and connection reliability. As the internet of things grows, the risk of a third party hacking a home network or device increases as well. These devices in the home are dependent on a connected network. This means that the internet service provider, the Wi-Fi router, extender, etc. must all be working well with one another in order for the smart home to work as designed. If the power goes out during a storm or a router fails, then the network could go down along with the devices it supports.

Premium Reduction for Smart Home Devices

Water detection is one of the most important IoT devices to insurance companies. Claims related to water leaks in the home remains one of the most reported claims to insurance companies. Some insurers are giving premium reductions to homeowners that install water detection sensors.

Smart home devices are here to stay. These devices benefit homeowners and insurance companies, but only time will tell how the marriage between the two will grow.

Source: Temporary Accommodations