Leather interior. Rearview cameras. Automatic emergency braking. While you may dream of a shiny new car with all these features and more, you may need to prepare for sticker shock. The average new car costs more than $40,000, and used cars average above $21,000. Of course you can buy a brand new car for as […]

All the Expenses You Need to Consider When Living on Your Own

You’re moving in to your first place. Maybe you are living with three roommates or maybe you are living completely on your own. Whatever your situation is, you are likely going to have a lot more expenses than you anticipated. An important step towards ‘adulting’ is setting a budget. But we hear this time and […]

Uncorking The Basics of Wine Insurance

Many of us simply open a $15 bottle of wine, pour a glass and sip it. Other people savor the art of collecting wine, whether it’s for pure pleasure or as an investment. But some of those collectors fail to insure their valuable vino – wines that can fetch hundreds of thousands of dollars per […]

Six Things Non-Profits Need to Know About Special Event Insurance

Holding a special event is a great opportunity for non-profit organizations to draw awareness to their cause and raise money to help expand their impact. However, even with the best intentions and careful planning, there are still risks. Third-party claims of bodily injury, reputation or advertising injury, or property damage can drain a non-profit organization […]

Reduced Home Insurance Premiums for Having Smart Devices

These days, many homeowners are using smart home devices to help keep their largest asset safe. As a result, many home insurance companies are offering discounts on their premiums for customers who use these items. However, since this technology is still fairly new, not all companies currently offer this perk. To that end, it’s important […]

Home Warranties – Like Insurance, But Different

You just bought the home of your dreams. Or maybe you’ve been living in your home for years. In either case, you’ll likely face the frustration and cost of repairing or replacing a failed kitchen appliance or major system, like an A/C or heating unit. If you’re about to buy a house, a failed appliance […]

‘Gotcha – You’ve Been Hacked!’: Handling a Cyber Claim for Your Business

Ever wonder what’s involved in handling a cyber claim? What is the process? Who needs to be notified of a cyber event? What steps should be taken to address the resulting chaos? If you follow Ash Burdon, cyber incident manager at CFC Underwriting, around for a day, you might not guess he works for an […]

What is Renters Insurance and Do You Need It?

Do you like your laptop? How about your sofa? Could you afford to buy them again if a fire destroyed your apartment? Do you have a plan to replace your clothes and jewelry if an uninvited guest picks the lock on your door and “borrows” them? No? Well then-you definitely need renter’s insurance. What is […]

COVID-19 and Homeowners Insurance

The coronavirus pandemic has disrupted many aspects of society, but your home insurance policy will continue to function normally. Will Homeowners Insurance Premiums be Affected by the Coronavirus Pandemic? It’s hard to say with any degree of certainty what will happen to homeowners insurance rates. There are many factors to consider. First, people are staying […]

COVID-19 is Prompting Families to Rethink Their Finances

COVID-19 has led families to cancel travel plans, get (semi!) comfortable with homeschooling kids and deal with all kinds of other inconveniences. As if that weren’t enough, it’s also making many families take a closer look at their finances and make sometimes difficult financial decisions. Life Happens recently conducted a survey that polled more than […]

Umbrella Insurance is the New Liability Coverage

It seems as though the wealthier an individual is, the higher the risk of being sued. It’s just one of the downsides of being affluent, especially if that person is also a business owner. In opportunistic lawsuits, primary policies like standard car insurance, home insurance and a business owner’s policy do not fully protect a […]

What to Know About Insuring a Historic Home

Whether your historic home is new to you or has been in the family for generations, an essential element of taking care of the property is adequate insurance. “Insuring a historic home can be very different from insuring a newer home,” said Dawn Meadows, an insurance adviser with Clarke & Sampson in Alexandria, Va. “The […]

Climate Change May Affect Your Homeowner’s Insurance Policy in Two Ways

You only need to watch the news once to understand that weather events have become more dramatic over the past 10 years. According to Maryland State Insurance Commissioner Al Redmer, whether you’re talking about tornadoes, floods, hurricanes, or wildfires, “Both the number and severity of natural disasters have increased” – and so have the number […]

What Every Horse Person Needs to Know About Insurance

Whether you board horses or rent them out for people to ride on your property, having the right insurance is crucial. It is also important when you are the person sending your horse to a boarding facility. There are many situations that could result in an insurance claim as these real news headlines show. “Horse […]

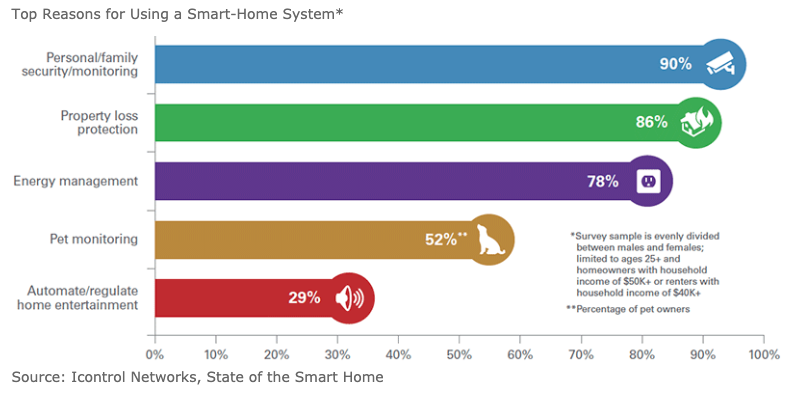

How Smart Home Technology is Influencing Home Insurance

By now, most Americans have grown accustomed to smart devices. Whether it is a smartphone or a smartwatch, we interact many times a day with some sort of smart device. These gadgets have changed the way we live providing unprecedented convenience and productivity. Smart devices in the home are no different. Over the last few […]

10 Ways Driving Analytics are Affecting Insurance

You may have noticed a lot of buzz about driving analytics lately, and for good reason. Driving analytics are primed to change the way vehicles and drivers are insured, and even conceivably change the way individuals drive, for the better. What is Driving Analytics? Also referred to as telematics, driving analytics tracks driver data like […]

Here’s What You Need to Know About Airbnb-ing Your Home

Sally Miller left corporate American when her first child was born to spend time with her growing family. But this also meant the family income took a hit, so she started exploring ways to make money from home. Hosting her four-bedroom home in San Jose, California on Airbnb turned out to be a great side-gig. […]

Top 5 Reasons Why You Should Consider Insurance as a Career

Whether you or someone you know is headed to college unsure of your path, graduated and looking for a job, or just looking for a career change, insurance should be on your list of jobs to research. Here are reasons why insurance is a great career choice. 1. A Stable Industry Insurance has been around […]

Personal Cyber Insurance: Deploy in Case of Attack

Your “internet of things” – that network of smart TVs, video game consoles, refrigerators and thermostats that make your life easier – poses a security threat. Where there is a threat, there’s (usually) insurance. Until recently, cyber insurance has been a product for businesses; now it’s an option for individuals. Personal cyber insurance pays out […]

How Hybrid and Electric Vehicles Affect Your Auto Insurance Quotes

For many hybrid drivers, ditching the gas guzzler for something a bit greener may be more about lifestyle than economics. But if you choose one of these vehicles, it could cost you when it comes to auto insurance quotes. Hybrid car insurance generally costs more than coverage for gas-powered vehicles, according to a 2008 study […]