According to the Insurance Information Institute (III), 67% of American households own a pet and dogs account for 63% of them. Unfortunately, sometimes dogs bite. Approximately 4.5 million Americans are bitten by dogs yearly and the average cost of a dog bite claim is $44,760, according to the III.

Does Renters Insurance Cover Dog Bites?

If you have renters insurance, dog bites are covered under your policy’s personal liability coverage. However, some renters insurance companies will not offer coverage based on the size and breed of the dog. You should inform your agent if you have a large dog and the breed to make sure you are covered in case of a dog bite.

Dog Breeds That Are Excluded From Renters Insurance Coverage

State Farm does not ask about dog breeds when issuing renters insurance because “under the right circumstances, any dog might bite, regardless of breed.” However, other insurance companies exclude large dogs and certain breeds from liability coverage.

Dogs known to be aggressive, trained attack dogs, unneutered male dogs, and dogs with a history of biting are usually excluded, according to American Family Insurance.

Everquote surveyed insurance companies and said these are the top 10 breeds most likely to be excluded from renters insurance policies:

- Pit bull

- Rottweiler

- Chow Chow

- Presa Canario

- Akita

- Doberman Pinscher

- Wolf hybrids

- Mastiff

- Wolf

- German shepherd

To be sure whether or not your dog is covered or to find out which carriers to do not have breed restrictions, talk to your insurance agent.

How to Get Coverage If You Have an Excluded Dog Breed

American Family noted that even if you have an excluded breed, you may be able to get coverage from an umbrella liability policy. An umbrella policy is additional liability coverage. It is available as an add-on rider to your renters insurance. The cost varies by insurance provider and is based on the additional coverage amount you select.

Talk to your agent to see if an umbrella policy will cover your breed. It is important to tell the agent your dog’s breed and size because if your dog bites someone and you failed to disclose the breed and size, renters insurance may deny your claim.

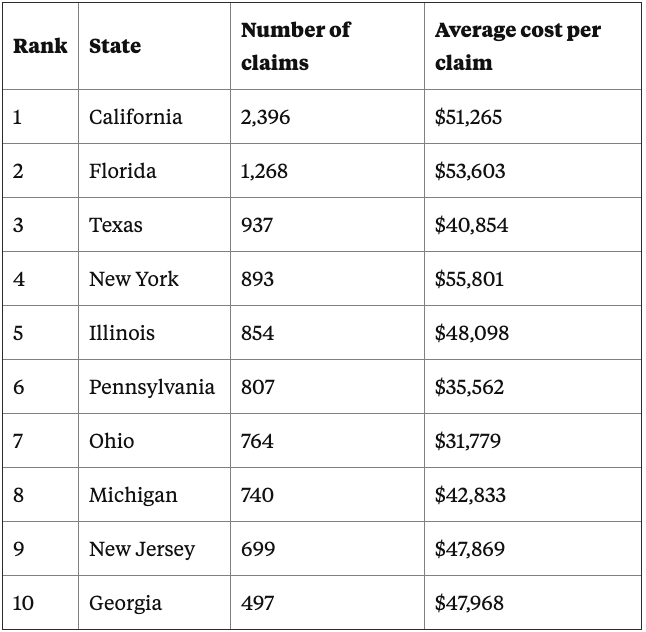

Top 10 States with the Highest Dog Bite Claims

If you live in one of these states, you will probably pay more for renters insurance if you have a dog due to the high incidence of dog bite claims.

(Data from the Insurance Information Institute)

Filing a Liability Insurance Claim for a Dog Bite

If your dog bites someone, you should notify your insurance agent immediately. According to Findlaw, “even minor injuries can lead to infection or nerve damage and it’s not uncommon for dog bites to result in personal injury lawsuits.”

Some states have laws that if a dog bites, the owner is strictly liable. That means it doesn’t matter if your dog was provoked or not, the owner is at fault. Therefore, you want to make sure your insurance company is on notice in case a lawsuit is filed against you. Failure to timely notify your insurance company can result in denying your claim — in which case you would be personally responsible for costs.

Be sure to talk to your landlord and insurance agent if you own a dog to make sure you are covered. Ask your agent about whether you need an umbrella liability policy if you have a large dog or a certain breed.

Article By: Ronda Lee

Source: Business Insider