**Study was done by ValuePenguin. Actual premiums may vary. Talk with your insurance agent for details regarding your own quote and vehicle.**

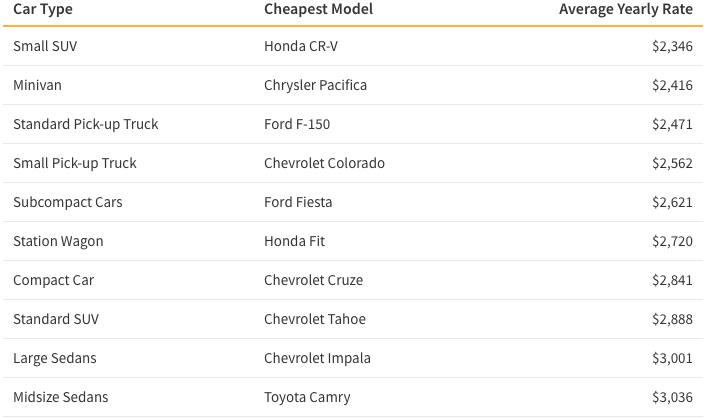

We looked at 50 of the most popular models on the road to see which were the least expensive to insure. Our research showed that minivans and small pick-up trucks were, on average, the least expensive cars to insure while large sedans had the most expensive insurance costs. Auto insurance costs are higher for certain vehicles for a variety of reasons – car car having high repair costs, a poor safety record or few anti-theft features will likely cost more to cover.

What is the Least Expensive Car to Insure?

We found that the Honda CR-V was the cheapest car to insure out of the 50 vehicles we considered, with an annual auto insurance cost of $2,346. This is a 22% less than the average yearly premiums across the all of vehicles we surveyed. Furthermore, the CR-V’s insurance costs were $2,397 less per year than the most expensive car to insure – the Tesla Model S.

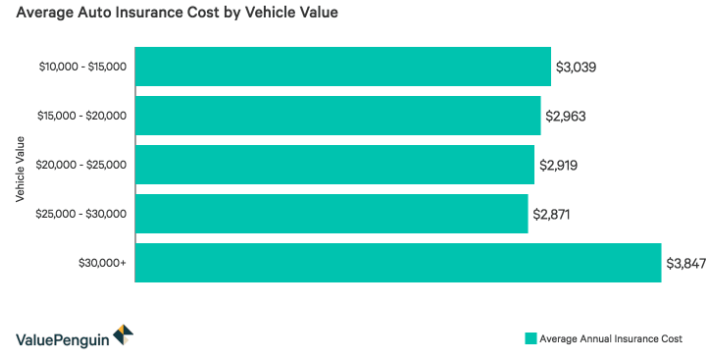

Our research showed that – contrary to conventional wisdom – the least expensive vehicles did not always have lower insurance costs than more expensive cars. Vehicles with values between $25,000 and $30,000 actually had the lowest auto insurance rates at $2,871 per year on average – 6% less than the cheapest cars with values between $10,000 and $15,000. However, the most expensive cars – with values of more than $30,000 – did cost the most to insure, with annual car insurance premiums of $3,847.

Cheapest Cars to Insure by Car Type

Car shoppers are likely to have a specific type of car in mind when buying a new vehicle, whether they’re looking to buy an SUV or a minivan. Here are the most affordable models to insure for every car type we looked at.

Which Car Make is the Least Expensive to Insure?

Americans have a large list of car makes, or brands, to choose from when it comes to shopping for a car. Our analysis found that certain car makes tend to skew a bit more expensive than others. For example, we found Honda and GMC vehicles tended to be cheaper to insure than luxury brands such as Mercedes and Tesla.

The Cheapest Car Type to Insure

Conventional wisdom says that large or fast vehicles are usually more expensive to insure. Interestingly however, the standard size pickup trucks actually proved to be cheaper – on average – to insure than compact cars. Below you can see which types of cars are usually cheaper to insure:

Why Does the Car You Drive Affect Your Insurance Rates?

Insurers set their prices based on how likely they predict that a driver of a certain vehicle will get into an accident or file a claim. If drivers of a particular model file claims at a high rate, then everyone who drives that car – even if they themselves have a good driving record – will have to pay more. This is why sports cars, that are more likely to be involved in accidents because of their high performance, often are expensive to insure.

Vehicles that cost more to repair – or have high market values – will also often have higher insurance rates. This is because insurance companies will anticipate having to pay out more for any comprehensive and collision insurance claims – which covers the cost to repair or replace your vehicle – for high-cost cars. Because of this heightened risk for insurers, they increase premiums.

Lastly, car theft also plays a role on your rates. Some cars get stolen more than others, so if you are driving one of those cars your rates are probably going to be higher. However, drivers should keep in mind that there are many factors at play that impact auto insurance rates, such as age.

How We Got Our Data

We gathered quotes from the four largest insurers – State Farm, Progressive, GEICO and Allstate – for a 30-year-old male with a clean driving record living in each of the four largest metropolitan areas in the U.S.: New York, Los Angeles, Chicago and Dallas. The insurance prices represent the total cost for full coverage policies with liability coverage limits above the state minimums. Average car values were obtained from CarGurus and car types are based on the EPA’s vehicle size designations.

Source: ValuePenguin

Leave a Reply

You must be logged in to post a comment.