Thanks to inflation, you’re likely paying more for just about everything these days, and car insurance is no exception. Insurers have increased rates by an average of 8.3% so far this year, according to data from S&P Global Market Intelligence, and costs for consumers will likely continue rising, say analysts at Bankrate. For insurers, the price […]

5 tips for first-time car insurance buyers

Whether you’re buying your first car or simply moving off your parents’ insurance for the first time, you might have some questions about getting your own car insurance. First, there’s the financial side of it, from figuring out what a fair price is to choosing coverages, limits, and deductibles that best fit your needs and […]

Can I Get Auto Insurance with a Foreign License?

With so many people from around the world living in the U.S., it is natural to wonder and ask, “Can I get auto insurance with a foreign license?” The short answer is that you can, but you may not be able to from every insurance company. We’ll walk you through what you need to get […]

What Are the Main Factors That Influence Car Insurance Premiums?

Insurance companies analyze a vast number of factors to determine the premiums paid by their customers. Some of these factors can be improved by the policyholders, while no one can improve other policy determining factors. The following top factors can have a significant impact on the premium paid by a policyholder: Demographic data. The driver’s age, […]

What Is Gap Insurance and How Does It Work?

If you drive a new car off the dealer’s lot, having made your deposit and looking forward to your first payment, but wind up in an accident that makes the car unusable, what recourse do you have? Guaranteed Asset Protection (GAP) insurance is the answer. What Is Gap Insurance? Guaranteed Asset Protection insurance protects the […]

How Much Car Insurance Do I Need? 5 Key Coverage Considerations

Of all the many adulting tasks we’re faced with, figuring out insurance is among the most confusing. Health? Life? House? Car? Yes! For car insurance, most state laws require every driver to have a minimum level of coverage, but how much and what type of coverage varies by state – so, should you get more […]

Check Your Auto Insurance if You’re Going to Make Deliveries

With much of the country practicing social distancing and self-quarantines due to the coronavirus pandemic, many companies are looking for delivery drivers to get groceries, takeout meals and other items to customers. If you’re looking to pick up some extra cash as a delivery driver and using your own car, be aware of possible auto […]

10 Ways Driving Analytics are Affecting Insurance

You may have noticed a lot of buzz about driving analytics lately, and for good reason. Driving analytics are primed to change the way vehicles and drivers are insured, and even conceivably change the way individuals drive, for the better. What is Driving Analytics? Also referred to as telematics, driving analytics tracks driver data like […]

What Insurance Does an Uber or Lyft Driver Need?

If you drive for a ride-hailing company like Uber or Lyft, or if you’re thinking of joining one, insurance coverage can seem like a secondary concern or something too complicated to tackle. But it’s more important than you think – and inaction could put you at risk. Do you have the right auto insurance to […]

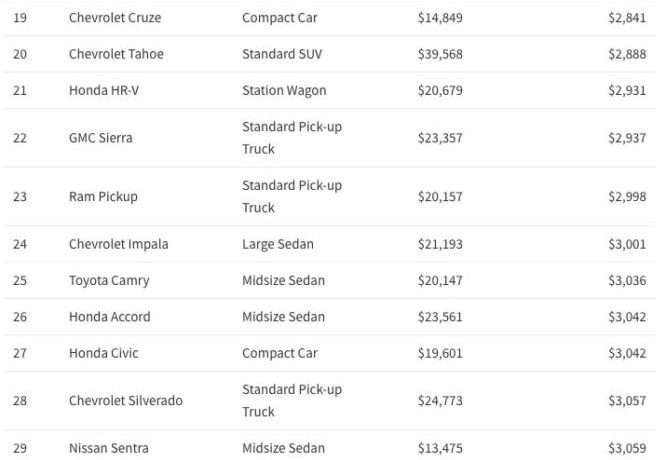

The Cheapest Cars to Insure in 2019

**Study was done by ValuePenguin. Actual premiums may vary. Talk with your insurance agent for details regarding your own quote and vehicle.** We looked at 50 of the most popular models on the road to see which were the least expensive to insure. Our research showed that minivans and small pick-up trucks were, on average, […]

8 Insurance Points to Consider Before Buying a Car

Most people know they need insurance for their new car, but in the excitement of buying a vehicle they may not research it as carefully as they should. Skipping over this detail may cause financial problems almost as soon as you drive off the lot. “You need to shop for insurance before you ever step […]

Types of Auto Insurance

There are several different categories of auto insurance and each covers a different aspect of your risk as a driver. Liability: If you are deemed at fault in a car accident, liability coverage will pay for repairs, medical costs for injuries suffered by others in the vehicle, plus other expenses related to the accident such […]