Premium

Many factors influence your premium and it will also vary by insurance company. An independent agent can help you shop for the best price without compromising your coverage. Some of the things that can affect your premium include:

- The cost to rebuild your home (this is not the same as the purchase price which includes the cost of the land).

- What your home is made of, such as brick or wood. The premium for a brick house is typically lower than a wood house of the same size.

- The distance between your home and a fire department or water source. The closer you are located, theoretically, the less chance of damage to your home when there is a fire.

- The age and condition of your home.

- Your claims history as well as the history of homes in your area.

- The coverage and deductible you choose will make a difference in your premium.

- Whether or not you bundle your home insurance with your auto insurance.

- The age of your roof.

- If you have smoke detectors, sprinkler systems, deadbolts or alarm systems. These can help you receive a discount with some companies.

- If you have a swimming pool, trampoline, playscape or even a certain breed of dog.

- If you operate a business from your home.

Policy Limits

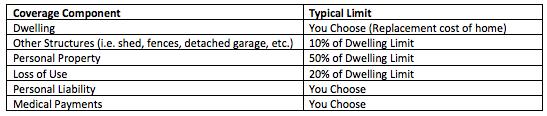

Your insurance agent can help you understand your current limits or help you decide how much coverage you need if you are buying a new home or looking to change your policy. Your coverage should equal the full replacement cost of your home (this is not the same as the market value). Your policy also has limits for other structures, your personal property and loss of use, which are typically a percentage of your dwelling limit. Typical limits can be seen in the table below.

Your agent can help you select the limit for personal liability and medical payments. If you are worried that you do not have enough coverage, you can also speak to your agent about an umbrella policy, which covers the costs that go above your Personal Liability limit.

Other Types of Home-Related Insurance

- Private Mortgage Insurance (PMI): Lenders typically require this when your down payment is less than 20% of the home’s purchase price. This type of insurance protects the lender if you default on your mortgage. It is often included with your monthly mortgage payment.

- Title Insurance: This protects you and the lender against any monetary loss due to errors in the title. This is typically only a one-time fee when you are purchasing the home.

- Home Warranty: This is an optional added coverage to cover the breakdown of individual appliances or mechanical components of your home. This often includes the electrical and plumbing systems and it may or may not include appliances, depending on the warranty selected. The warranty does not cover the home’s structure and typically ends at a certain time, such as after one year from when you purchase your home.

Leave a Reply

You must be logged in to post a comment.