There is no shortage of reasons your home insurance rates may have gone up, but the likely culprits in 2022 are rising labor and construction costs due to inflation and expensive natural disasters. Around a month before the end of your policy term, your insurance company will send you a notice reminding you that your homeowners […]

3 ways to reduce your homeowners insurance premium as costs rise in 2022

Homeowners may see an increase in their homeowners insurance premiums this year. In October 2021, S&P Global Market Intelligence reported a 3% to 30% rate hike in insurance premiums across major home insurance providers, with State Farm having the most significant rate increase. The report also found that Texas saw the most significant increase in homeowners insurance […]

Important Insurance for Young People

Life comes at you fast. Insurance helps. You’re young. You’re healthy. You know insurance is important — but it can also be expensive. Plus there are many different kinds. There’s health insurance, of course. But there’s also vision insurance and dental insurance. There’s car insurance and renters insurance, too. Are all of them really necessary? And […]

COVID-19 and Homeowners Insurance

The coronavirus pandemic has disrupted many aspects of society, but your home insurance policy will continue to function normally. Will Homeowners Insurance Premiums be Affected by the Coronavirus Pandemic? It’s hard to say with any degree of certainty what will happen to homeowners insurance rates. There are many factors to consider. First, people are staying […]

10 Facts You Should Know About Weather-Related Home Insurance Claims

Weather-related home insurance claims can be a whole separate ball game from other home claims. “Weather losses are always more complicated because you’ve got thousands of people experiencing losses at the same time. These events are taxing on the entire community, whereas if you have one loss, such as a water main break in your […]

What You Need to Know About Flood Insurance

Flood insurance is an important policy for most homeowners to have. But only about one in seven homeowners purchase this critical safety net to protect them from the ravages of flood water. What is Flood Insurance? Flood insurance is a specialized policy that protects your home and belongings against damage from flood waters. If you’re […]

Climate Change May Affect Your Homeowner’s Insurance Policy in Two Ways

You only need to watch the news once to understand that weather events have become more dramatic over the past 10 years. According to Maryland State Insurance Commissioner Al Redmer, whether you’re talking about tornadoes, floods, hurricanes, or wildfires, “Both the number and severity of natural disasters have increased” – and so have the number […]

Dog Bite Liability

Almost 90 million dogs are owned as pets in the United States according to a 2017-2018 survey by the American Pet Products Association. According to the Centers for Disease Control and Prevention, about 4.5 million people are bitten by dogs each year. Among children, the rate of dog-bite related injuries is highest for those 5-9 […]

Condo vs Homeowners Insurance

In many ways, buying a condo is similar to buying a house: you get the freedom of owning your living space but you also have to take responsibility for what happens to it. So how similar are insurance coverages for condos and houses? Let’s find out. Condos vs Houses: The Ins and Outs of Your […]

Homeowners Insurance: Premium, Policy Limits and Other Home-Related Insurance

Premium Many factors influence your premium and it will also vary by insurance company. An independent agent can help you shop for the best price without compromising your coverage. Some of the things that can affect your premium include: The cost to rebuild your home (this is not the same as the purchase price which […]

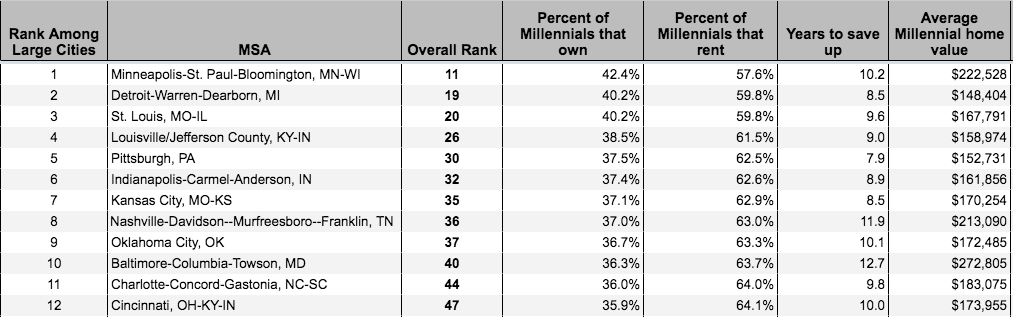

Renters No More: Millennial Home Buyers

According to Primary Residential Mortgage Inc., Millennials are currently the largest class of homebuyers in the market. It may come as a surprise to some, but this young, tech-savvy generation is still set on finding a home, even during a volatile market with rising interest rates and fewer homes on the lower end of the […]

Water Damage in Your Home

Water damage is the leading cause of property-related losses for homeowners, according to Chubb claims data. A recent Travelers report revealed similar findings. After analyzing eight years of claims data, the insurer found that 20% of homeowners claims were attributable to non-weather water issues including plumbing, sewer or appliance leaks and failures – making non-weather […]

One-Third of Homeowners Liability Claims are From Dog Bites

In 2017, dog bites and dog-related injuries accounted for more than one-third of homeowners liability claims according to the Insurance Information Institute. There are approximately 89.7 million dogs in the United States and 36.5% of U.S. households own at least one dog. The average cost per dog bite claim was $37,051, totaling over $700 million […]

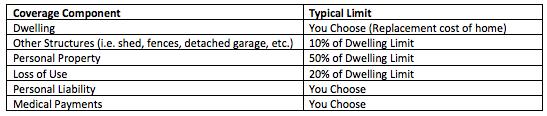

Breaking Down Your Homeowners Policy

Homeowners insurance is important to many people and is often required to satisfy your mortgage requirements. But how well do you actually understand your policy? Most homeowners policies can be broken down into six sections. Dwelling: This pays for damage to your house and structures that are attached to your house. This includes plumbing, electrical […]